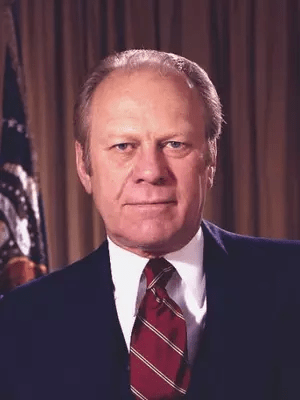

Gerald Ford, a fiscal conservative, stood repeatedly against income tax reductions that did not come with budget reductions.

The policies on income taxes have changed a bit over the decades, notably with the conservatives in terms of how they approach the subject when it comes to deficits. Namely, they care less about deficits in relation to tax reduction than they used to. The history surrounding this also largely counters liberals who cite the tax system of the 1950s positively. There were calls for reform from both liberals and conservatives of the time, but in different directions.

Liberals – Curbing Tax Deductions, Focusing on the Working Class

Liberals of the 1950s realized that the tax code had numerous loopholes that made the effective rate considerably lower than the 91% statutory rate. On September 28th, 1951, Senator Hubert Humphrey (D-Minn.) proposed an amendment to eliminate income splitting, which resulted in lower tax rates for families with over $10,000 in income if the husband and wife reported their income separately. This proposal was rejected 15-62, and counted by Americans for Democratic Action as a positive. Liberals also were interested in pushing certain tax reductions to primarily help the working class that were deficit-financed. For 1955, both ACA and ADA counted for their ratings the March 15th the vote defeating a tax credit of $20 per person regardless of income. ACA supported eliminating the $20 tax credit, citing that it would have eliminated 5 million people from the taxpayer rolls and resulted in a $2.3 billion annual loss in revenue, regarding the vote as “FOR Sound Money & AGAINST Inflation” (Americans for Constitutional Action, 1960, 40). Americans for Democratic Action, on the other hand, favored the tax credit. Another instance of liberals supporting tax reduction and conservatives opposing was when on June 18, 1958, Senator Paul Howard Douglas (D-Ill.) offered an amendment to reduce personal income taxes by $50 as well as repealing or reducing excise taxes and reducing taxes on small businesses. ACA regarded the vote in the category of “FOR Sound Money & AGAINST Inflation” in their opposition to the measure, which they opposed for reducing annual revenue by an estimated $6 to $6.3 billion annually while there was a deficit (Americans for Constitutional Action, 1960, 38). This was rejected 23-65, with most Republicans voting against this proposal and a majority of Democrats doing so as well. ADA had counted the vote favorably in their scorecard. This is not to say that conservatives didn’t like the idea of income tax reduction, indeed they had pushed an income tax reduction over President Truman’s veto in 1948. They wanted income tax reductions to be paid for by budget reductions.

One famous tax reduction effort started during the Kennedy Administration. On September 25, 1963, the House passed a tax reduction bill 271-155, and this was counted as a plus by Americans for Democratic Action and a negative by Americans for Constitutional Action. This vote fell on liberal vs. conservative lines and it was based on the question of inflation. Liberals supported deficit financing for tax reduction while conservatives were against its potential inflationary impact.

In the following year, ACA included two votes surrounding tax reduction. The first was Senator John McClellan’s (D-Ark.) amendment placing a limitation on tax reduction and the tax reduction bill itself. McClellan’s amendment was directly in opposition to the Keynesian nature of the Kennedy tax cut, which was meant to be deficit-financed. ACA itself explained its opposition to the tax reduction bill thusly, “ACA firmly believes that a “tax cut” is necessary for it will act as a stimulus to our national economy by presenting the opportunity for greater investment by the private sector of our society. However, tax reductions during periods of budgetary deficits can only lead to additional inflationary pressures. A realistic tax reduction program should be coupled with efforts to decrease Federal expenditures with the objectives of securing balanced budgets” (Americans for Constitutional Action, 1964, 12). The bill itself, which reduced the top income tax rate from 91% to 70% and corporate rates from 52% to 47%, passed the Senate 77-21 on February 7th. Supporting this measure were staunch liberals such as Ted Kennedy (D-Mass.), Hubert Humphrey (D-Minn.), and George McGovern (D-S.D.), and opposing were conservatives such as Barry Goldwater (R-Ariz.), John J. Williams (R-Del.), and John Tower (R-Tex.). The economist who advised Kennedy to push for a tax reduction was Keynesian Walter Heller, who despite Reagan and Republicans adopting tax reductions in the 1980s, he didn’t embrace Reagan and Republicans, backing Walter Mondale in 1984 (Kansas State University). This post hasn’t even yet mentioned the largest tax loophole in the system, the oil depletion allowance, which allowed for the first 27.5% of revenue to be tax free, and this was an allowance that liberals repeatedly sought to reduce. Although generally the debate on this one went in a liberal-conservative direction, with liberals supporting reduction of the depletion allowance and conservatives supporting retaining the depletion allowance. Although Americans for Democratic Action repeatedly counted this as an issue, the conservative Americans for Constitutional Action never counted this as an issue. There were simply questions for them that were seen as more ideologically relevant for them, and they weren’t overly inclined to render favorable judgment on a question that outright favored one sector of the economy, albeit a highly important one for the economy and national defense in oil.

In 1975, conservatives again opposed tax reduction proposed by Democrats, which if enacted would have reduced individual and business taxes by $15.5 billion without the $395 billion ceiling for 1977 federal spending requested by President Ford. President Ford vetoed the tax reduction, writing in his veto message to Congress, “I have clearly stated ever since last October 6 that I would veto any tax cut if you failed to cut future Federal spending at the same time. You have refused at this time to put any limit on spending for the fiscal year and instead sent me a temporary 6-month extension of the present temporary 1975 tax levels due to expire on New Year’s eve” (The American Presidency Project). Ford had voted against the 1963 tax reduction as a member of Congress, and interestingly among the votes in support of his position was Jack Kemp (R-N.Y.), who would later spearhead the GOP’s approach of placing tax reduction over budget reduction in the party’s priorities. Although President Ronald Reagan is most commonly associated with the “voodoo economics” as George H.W. Bush put it, he wasn’t actually a believer in the concept of lower taxes meaning more revenue. This is demonstrated in his embrace of the 1982 Tax Equity and Fiscal Responsibility Act, which although it raised no income tax rates that were in effect at the time, it did cancel certain future reductions and hit particularly hard were business tax reductions. Conservatives had universally embraced the 1981 tax reduction despite deficits as a way to help out the flagging economy, and it certainly was something needed when you consider the interest rate cuts the Federal Reserve did to curb inflation. Liberals became more interested in the budgetary impact of tax reductions for cutting into funds for domestic programs.

Although I support lower income taxes, in the future I want these tax reductions to be paid for, which can be done by budget cuts as well as tax loophole and deduction closings. I frankly think it is time to get back to old-fashioned conservatism on finances, and the recent inflation has proven the problem of not doing so. Too many people in our politics are willing to go with deficit financing, and it is costing us in the long run. The question is, are we willing to continue to accept this cost?

References

ACA Index. (1960). Americans for Constitutional Action.

ACA-Index Second Session 88th Congress. (1964). Americans for Constitutional Action.

ADA World – Congressional Supplement. (1951, October). Americans for Democratic Action.

ADA World – Congressional Supplement. (1955, September). Americans for Democratic Action.

Retrieved from

ADA World – Congressional Supplement. (1958, September). Americans for Democratic Action.

Retrieved from

ADA World – Voting Record Supplement. (1964, January). Americans for Democratic Action.

Retrieved from

Dr. Walter H. Heller – Regents Professor of Economics at University of Minnesota. Kansas State University.

Retrieved from

H.R. 8363. Passage. Govtrack.

Retrieved from

https://www.govtrack.us/congress/votes/88-1964/s264

Veto of a Tax Reduction Bill. The American Presidency Project.

Retrieved from

https://www.presidency.ucsb.edu/documents/veto-tax-reduction-bill